Forex Trading

ITG Traders offers traders access to 60+ currency pairs. Access the worlds largest

financial market with spreads from 0.0 pips and thick top of book liquidity

Trade Forex with ITG Traders

The global foreign exchange market is one of the fastest and exciting financial markets. The FX market is by far the most liquid market in the world with trillions of dollars changing hands every day. Join the thousands of people who already trust ITG Traders to provide access to all the major currency pairs including GBP/USD, EUR/USD and USD/JPY among others.

ITG Traders offers consistently tight pricing, starting from as low as 0.0 pips. Our liquidity relationships include tier 1 investment banks and non-bank FX houses to ensure a thick top of book liquidity so that you get the best execution experience possible.

ITG Traders is founded by traders and our mission is to provide a seamless trading experience across all of your devices. MT5 offers an outstanding charting package meaning you can make the most informed decisions when entering the financial markets.

ITG Traders is committed to helping traders succeed. With our online education portal and personal account manager available at your fingertips, you can start trading forex with as little as $100 and a maximum leverage of 1:400

We know the Forex Market

Start trading with knowledge

Forex Trading Leverage

Get highly competitive leverage of up to 1:400 in over 60 currency paris widening your market reach

Low Latency Execution

Get all available markets with tight pricing, no latency and minimal slippage

Reputation

We've educated thousands of traders over the last 5 years on how to trade and enter the markets safely. We know what you need

Trading Platforms

Access the global financial markets across all of your devices so you're allways in control

What is forex trading?

Trading forex involves simultaneously buying one currency and selling another. Through a combination of technical and fundamental analysis, traders speculate on the potential direction of currency prices and attempt to capture gains based on price movements. The forex market has no central exchange, however it takes place electronically on the global network of devices. The market is open 24 hours a day, 5 days a week.

Keep in mind that some countries follow daylight savings and this can affect the trading session hours as well as the session times that you are trading on if you reside in one of these countries, so its important to plan your trades accordingly. The liquidity for different pairs can vary dramatically based on what trading session you are in. For example, AUDUSD may have more liquidity in the Sydney/Asian session where has EUR/GBP OR EUR/USD may have more liquidity in the London and New York session. Generally volumes and liquidity across all pairs is highest in the London and New York session.

An example of leveaged CFD trading

Suppose you want to trade CFDs on crude oil. For this example, we will look at OILUSD. Lets suppose this instrument is trading at:

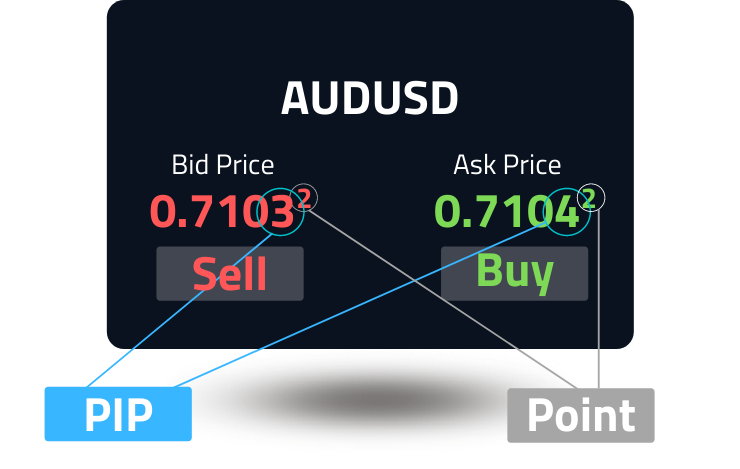

Bid, ask and spread

You can only buy at a price that someone is willing to sell at (ask) and you can only sell at a price that someone is willing to buy at (bid). The difference between these two prices is called the ‘spread’. This is the cost of entering the trade. Depending on the liquidity of the market, the broker your trading with and which instrument you are trading, the spread may be very tight, or quite wide. At ITG Traders, we source liquidity from a wide range of liquidity providers to ensure we can offer the tightest bid/ask spreads.

Lets say you decide to buy 200k AUD/USD because you think the price of AUD will rise vs the USD. Your account leverage is 1:400. This means you need to deposit a minimum of 0.25% of the notional value of the position

So, you need to deposit:

0.25% x (AUD 200,000 x 0.7104)

=$355.20

Lets say in the few hours the price of AUD/USD has moved to Bid: 0.7113 and Ask: 0.7114. At this point you have a winning trade and you could close the trade by selling at the price of 0.7113.

Your profit would be:

200,000 x (0.7114-0.7104)

=$200.00

Forex Quotes & Rates

Currencies are always traded in pairs, such as AUD/USD or EUR/GBP. They are always denominated in 3 lettered codes such as AUD (Australian Dollar), EUR (Euro) or GBP (Great British Pound). Whenever you see a currency quote, the first currency is the base currency and the second currency is the ‘term’ or the ‘quote’ currency. For instance, say the AUDUSD is trading at 0.7104. This means to buy one unit of AUD you will need 0.7104 USD.

The higher price is always the ask price, while the lower is always the bid price. The bid price is the maximum price someone is willing to buy the currency for, while the ask price is the lowest price someone is willing to sell the currency for. These rates are dynamic and are constantly changing due to supply and demand, market liquidity and economic news events.

Spreads

What are 'pips'?

‘Pip’ is simply an acronym for ‘Point in Percentage’. It represents the smallest rate of change in an exchange rate and it is a standardised figure. For currencies with 4 numbers after the decimal place (like AUDUSD) one pip = $0.0001, however for some currencies like the Japenese Yen (JPY) one pip = $0.001.

Pip value fluctuations have an effect on trading gains or losses. For example, if you decide to buy €10,000 and the EUR/USD pair is trading at 1.1086, the price you will have to pay will be $(10,000×1.1086) or $11,086.

If the exchange rate for this pair sees a 5-pip increase, which means the EUR/USD is now trading at 1.1091, then to buy €10,000, you will have to pay $11,091.

We know forex. Start trading with knowledge

How to trade forex

Here’s 4 easy steps to learn how to get started in the forex market.

Step 1 > Educate Yourself

Learn all about the market. It’s important you have a solid foundation and know what you’re doing before making any investment decisions. Jump over to the ITG Live page to start your forex journey.

Step 2 > Open your brokerage account

A quick and easy application with ITG Traders means you can start trading in less than an hour.

Step 3 > Deposit Funds

We have quick and easy funding and withdrawal methods which means you can get started trading with minimal hassle.

Step 4 > Start Trading

Away you go! Start trading the bull and bear markets and profit from any market move with the flexibility that ITG Traders offers its clients.

Start trading with ITG Traders

Fast account opening in 3 easy steps

1

Register

Choose account type and complete our fast and secure application form

2

Fund

Fund your account through our wide array of fast and easy methods

3

Trade

Start trading and access 80+ instruments across our platforms